|

Hey TONYA!

Here's to hoping you had a great summer, and welcoming a beautiful fall! I must start with an apology for staying away so long. Maybe I hadn't shared with you, but I stepped away in June with honors, so that I could be prime caretaker of my mom, who went through double knee replacement. While the journey has been a long one, I am happy to report that she's doing wonderful, and recovery is progressing. So much that, next week, I will be resuming to my full-time operations! Here's to hoping you had a great summer, and welcoming a beautiful fall! I must start with an apology for staying away so long. Maybe I hadn't shared with you, but I stepped away in June with honors, so that I could be prime caretaker of my mom, who went through double knee replacement. While the journey has been a long one, I am happy to report that she's doing wonderful, and recovery is progressing. So much that, next week, I will be resuming to my full-time operations!

CHEERS!

We made it to the final stretch... 4th quarter! My how time flies. We are already into October, and pretty soon, we will need to start thinking about New Years Resolutions and preparing for those taxes.

Before we get into all of that... May I please have a few more minutes of your time to share what we here at DEFY Consulting Group has been working on?

I'm super excited to announce... (DRUM ROLL PLEASE...  Well actually, I have 3 major announcements. Well actually, I have 3 major announcements.

1) D.E.F.Y. Consulting Group was one of the small business’ selected to participate in the SCORE Fort Worth Masterclass 2021, sponsored by Prosperity Bank. To learn more, please click here and read the press release.

2) D.E.F.Y. Consulting Group is now Officially on YouTube!!!!!!! I need you to check us out, like and subscribe! Click here to visit our official YouTube Channel.

You've been asking for it, so access is now been granted. You will learn financial management DIY tidbits, lessons, definitions, demos, and most of all easy solutions, in a judgement free zone. We will educate and empower you. You will know your numbers both professionally and personally so that you can scale your business and be bank ready or, so that you can fearlessly start that business you've always dreamed of.

And if you haven't already, be sure to check us out on Instagram and Facebook. WE ARE SOCIAL! Grab some freebies, check out our special offers and stay tuned for our next contest. Sending out the good juju so you, (yes, you, TONYA!) will be the winner.

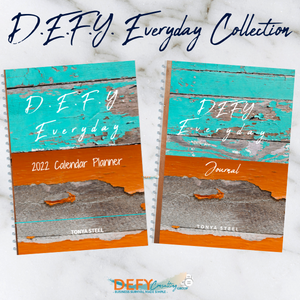

3) The D.E.F.Y. Everyday Collection on Amazon and Lulu. The D.E.F.Y. Everyday Collection was designed to help the entrepreneur, the working professional, the stay-at-home, the retired, the organizer, the student or anyone defy the odds of planning and of staying organized. With our collection, you can declutter your mind, and focus on the tasks at hand, all while increasing efficiency and productivity. Get yours today. professional, the stay-at-home, the retired, the organizer, the student or anyone defy the odds of planning and of staying organized. With our collection, you can declutter your mind, and focus on the tasks at hand, all while increasing efficiency and productivity. Get yours today.

The D.E.F.Y. Everyday 2022 Calendar Planner will help you manage your stress while being productive. The D.E.F.Y. Everyday Journal notebook allows you to capture your thoughts, memories, ideas, and is great for notetaking.

Each product comes in three different styles – coil bound, hardcover, or paperback, and can be purchased on Amazon and LuLu.

We have more products to add to the D.E.F.Y. Everyday Collection, so stay tuned.

Last but not least, with 3 months left of this calendar year, I want you all to start getting tax-ready, now! COVID-19 is still very much real, and most are still feeling its financial impact. I want you to end the year in the best financial position possible. Do me a favor, start taking a look at your most current paystubs... Do you need to do a little tax -reconstruction? No judgment! Just want you to go into the new year with a realistic perspective.

Right now, with paystub in hand, do these simple steps: Right now, with paystub in hand, do these simple steps:

1. Look at total gross distributed amount (or the total you've been paid before taxes)

2. Look at your tax withheld. As a rule of thumb, the tax withheld should be approx. 10% of your gross payout. Ex. if your gross year-to-date number is $56,219, then 10% of that is approx. $5,622. That's at a minimum the amount of taxes that should be withheld.

a. If you're there, or have more withheld, you're likely going to be okay... (assuming best case scenario)

b. If you're a little or a lot under that, let's set up a quick time to meet, to see how you can finish strong, and make any adjustments while time is left in 2021.

a. Schedule a Time to Meet

3. If you still have any 2020 unresolved tax issues, please remember the deadline to file is October 15, 2021. Let me know if you need to discuss or schedule an appointment to go over your unique concern.

Until next time,

Take Care.

|